Are you going to buy a cell phone from China or do you want to invest in a Swiss watch? You can do all this legally using the Correios “My Imports” feature. Learn what it is and how to use the tool to receive your imported products easily.

What is My Post Office Imports?

The Post Office's Minha Importações service serves to make life easier for people who consume products from abroad so that they can receive them. This is a system that ends up being very complete and many details to help the user. Therefore, even in the initial phase, the platform already provides information on the requirements demanded by the Federal Revenue Service and by the bodies responsible for releasing the enenda.

In addition, still in this Correios system, in Minhas Importações, it is possible to pay taxes, services related to imported products and find out about the supplementary documents required for the customs clearance process.

In this case, we will explain the situation of “Import one”, the most normal to use between individuals and legal entities.

Read also:

- Correios: knowing prices and deadlines for enendas

- tracking orders on the Correios website

- tracking my order on Shopee?

o use the My Imports service?

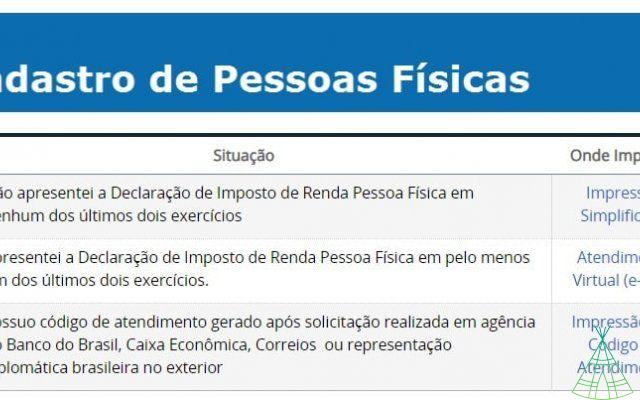

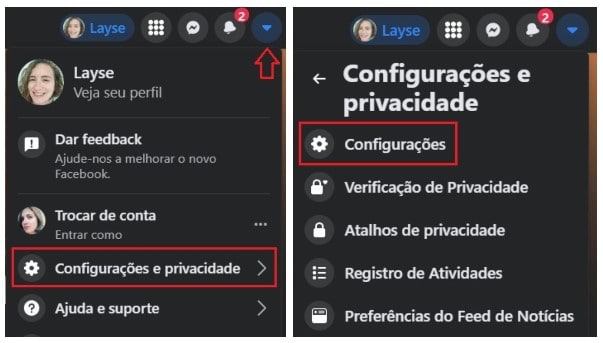

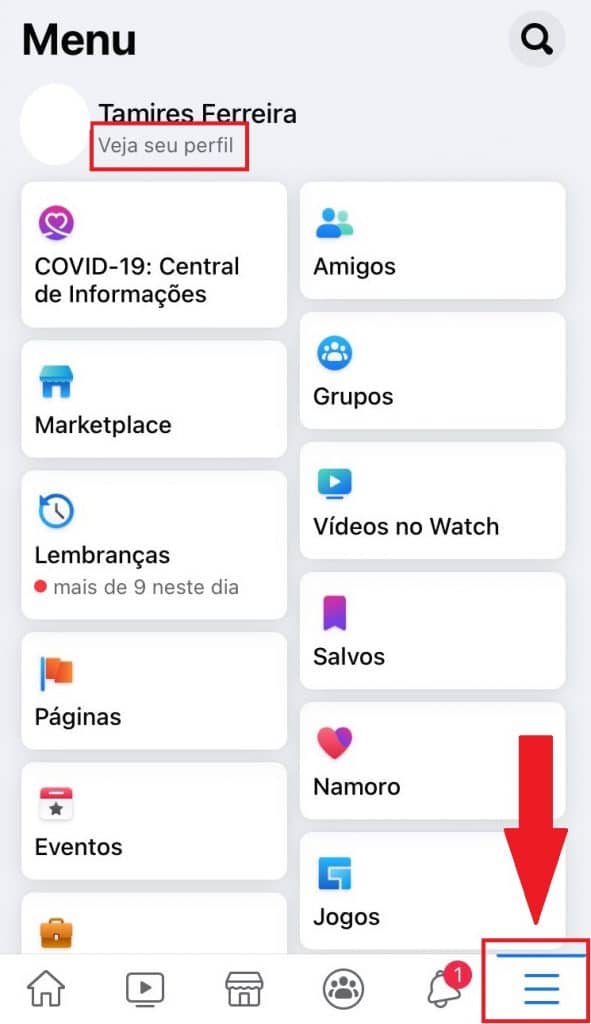

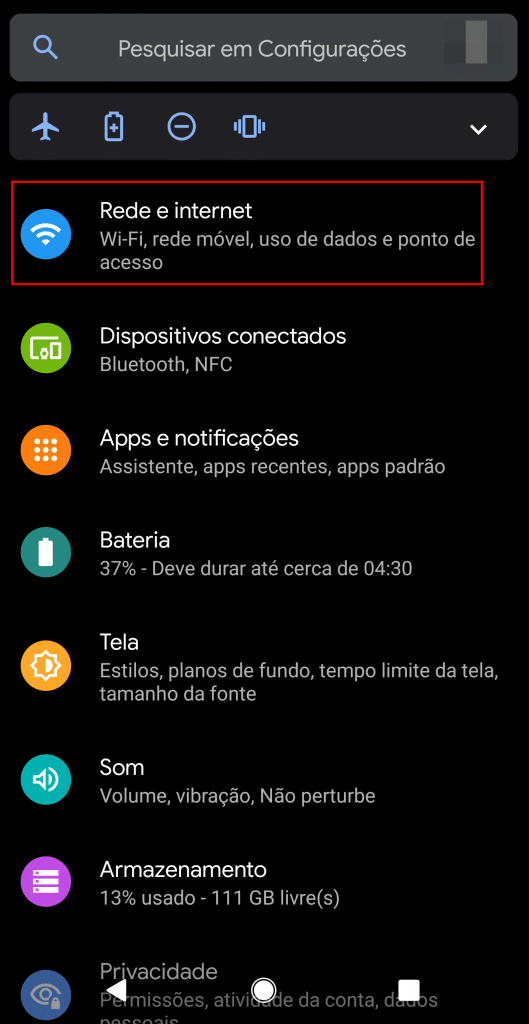

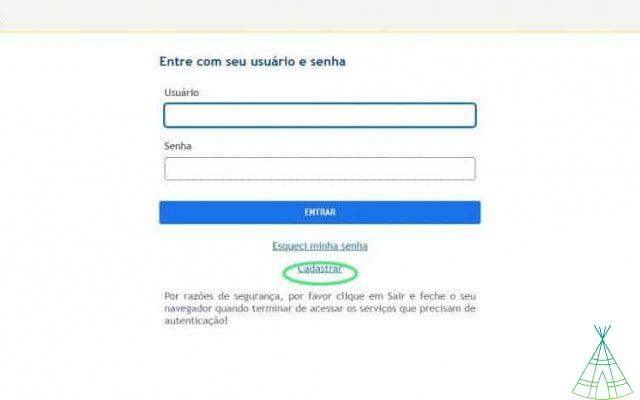

To start the process in Minhas Importações, it is necessary to register on the Correios website. Something simple, which will recognize you via SMS and guarantee your safety and that of your products.

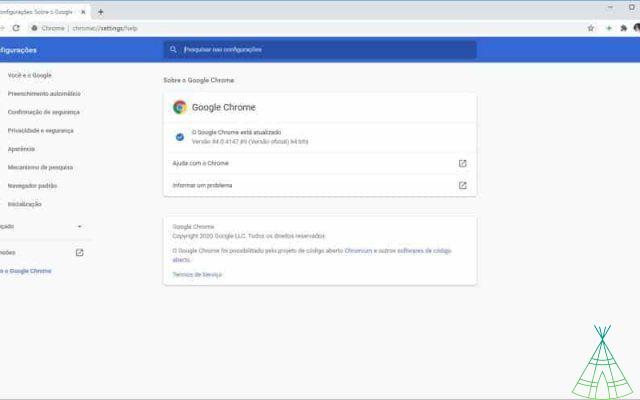

After that, as previously mentioned, the focus for the general population would be Import one. This mode is the “flagship” of Minhas Importações, as it caters to all audiences. That is, individuals and legal entities, a limit of up to US$ 3.000 in the product and a Postal Dispatch fee (Customs Support) of R$ 15. However, customers should be aware of the IN1737/2017 standard.

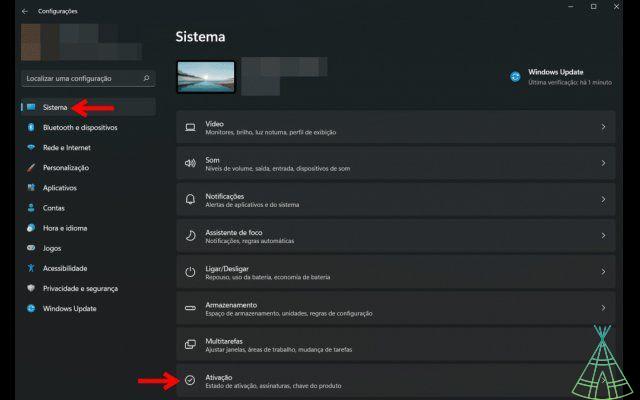

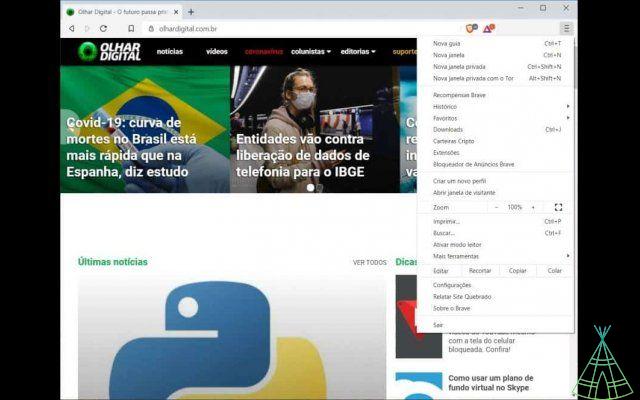

Then, it will be necessary for the customer to pay the amounts of taxes and services, by bank slip or credit card. After payment, you have the documentation, which the Correios platform allows you to do via the internet. Therefore, in Minhas Importações you will have the necessary support to upload supplementary information files whenever requested by the Federal Revenue Service or by the consenting bodies. Just follow the following topics:

• The file format must be PDF, JPEG or TIFF;

• The file size must be a maximum of 2 MB;

• The maximum number of attached files is five files.

o pay taxed import?

International products have a single Import Tax rate of 60% on the customs value, which would be the value of the goods + freight + insurance. In addition, there is the ICMS, which contains different rates according to the destination state of the object.

Finally, after payment, there will be postal support, which will include receiving the objects, X-ray inspection, storage, collection and transfer of taxes (if any), recipient and sender identification, in addition to the return of the enenda when the recipient does not carry out the payment of taxes.

If your product is taxed, this is how the problem will be resolved. However, there is a possibility that the product will not be taxed and if not, it will only be necessary to pay the Postal Dispatch. In addition, it is possible to dispute the amount of taxes before issuing the bill.

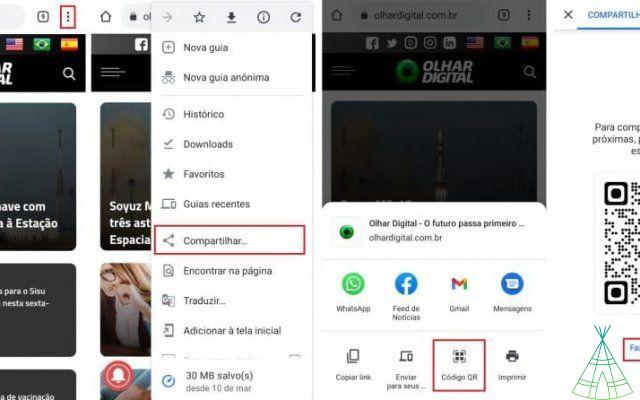

See the step by step:

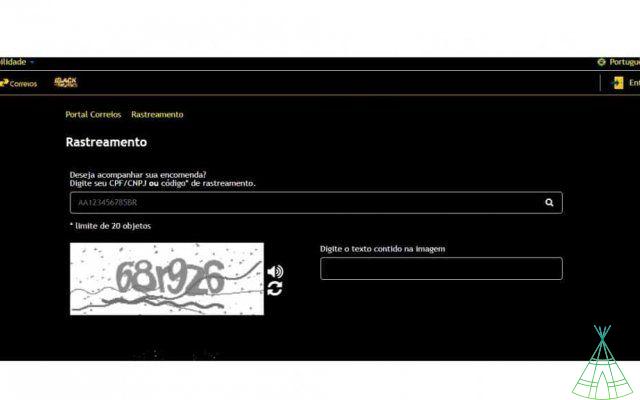

o track my imports?

Tracking international products is not difficult. However, obviously, the fees must be paid and the product legalized. After that, through the Minhas Importações website, it will be possible to go to the tracking part and enter the necessary information for tracking.

Have watched the new videos on YouTube from Technology Refugee? Subscribe to the channel!